3 reasons to become an Air Liquide shareholder

Air Liquide has always been committed to a growth path. The Group aims to carry out its actions in a framework of global growth, placing economic performance and sustainable development at the center of its strategy to contribute, along with all its stakeholders, to building a sustainable future.

A RESILIENT GROUPAir Liquide’s business model, which is both diversified and extremely resilient, coupled with the expertise and commitment of its teams, allow the Group to report consistent results each year while making a firm commitment to the future. The Group’s strong performance underlines the relevance of its strategic choices, allowing it to build profitable, steady and responsible growth over the long term.

A GROUP THAT IS WELL POSITIONED FOR FUTURE GROWTHAs part of its growth strategy, the Group is focused on the quality of its positioning on the markets of the future to pave the way for new growth opportunities. Air Liquide is deeply committed to the climate and the energy transition. The Group fully believes in the major role that its decarbonization solutions - and in particular hydrogen - will play in the development of a low-carbon society.

Healthcare, which has taken on a new scale during the health crisis brought about by COVID-19, also represents one of the focuses of future growth. In a world where technological progress is rapidly accelerating, especially in the digital field, the Group is perfectly positioned in the race to future growth. By putting our expertise into action we can, for example, support the expansion of the electronics industry as well as the high tech sectors of deep cryogenics, space, and quantum technology. The Group firmly believes that its technologies and ability to innovate will make a difference in the transformation that is currently underway.

In addition to its robust business model, the Group’s performance is based on rigorous management, proprietary technologies, a long-term vision and the ability to capture new sources of growth. In recent decades, Air Liquide has demonstrated its ability to sustain a steady and solid financial and stock market performance over time:

- Growth in adjusted net earnings(1) per share of +6.7% per year on average over 30 years(2);

- Total Shareholder Return (TSR) of +10.68% per year on average over 20 years(3).

Air Liquide targets long-term profitable growth.

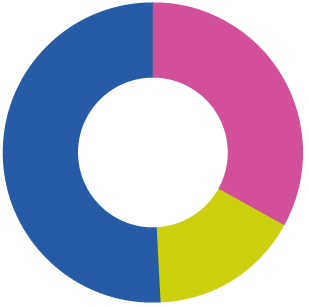

Dividends paid typically represent around 50% of net profit. On top of this pay-out ratio, the Group regularly grants free shares to shareholders and a loyalty bonus system to those that have held their shares in registered form for more than two full calendar years.

Note: the past performance of the Air Liquide share is not necessarily an indicator of its future performance.

78

countries

64,500

employees

+ than 3.8 million

customers and patients

+ than 20 billion

euros in revenue

+ than 2.4 billion

euros in net profit

(Group share)

2020 data.

(1) Adjusted for the 2-for-1 share split in 2007, attributions of free shares and the capital increase completed in October 2016.(2) Calculated over 30 years according to prevailing accounting standards.(3) Return before tax calculated at December 31, 2020, for 100 euros invested in Air Liquide shares in 2000 by a registered shareholder who reinvested their dividends each year in shares and benefited from the free share attributions, both eligible for the loyalty bonus, and who reinvested their preferential subscription rights in shares during the 2016 capital increase.